Homestead exemption brazoria county images

Home » Wallpapers » Homestead exemption brazoria county images

Your Homestead exemption brazoria county images are ready in this website. Homestead exemption brazoria county are a topic that is being searched for and liked by netizens now. You can Get the Homestead exemption brazoria county files here. Find and Download all free vectors.

If you’re searching for homestead exemption brazoria county images information connected with to the homestead exemption brazoria county interest, you have pay a visit to the ideal blog. Our site frequently provides you with hints for viewing the maximum quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

Homestead Exemption Brazoria County. Download the Homestead Exemption Form here. Homestead exemptions remove part of your homes value from taxation which depending on the value of your home could potentially save you thousands each year. Age 65 or Older Exemption. If you live in Harris County you are in luck.

2602 Mountain Sage Drive Pearland Tx 77584 Har Com Perry Homes Pearland Entry Foyer From pinterest.com

2602 Mountain Sage Drive Pearland Tx 77584 Har Com Perry Homes Pearland Entry Foyer From pinterest.com

A Texas homeowner may file a late county appraisal district homestead exemption application if they file no later than one year after the date taxes become delinquent. Homestead exemptions reduce the appraised value of. Surviving Spouse of an Individual Who Qualified for the Age 65 or Older Exemption. Chambers County Appraisal District Tax Information. And 3 the property was your residence homestead when your deceased spouse died and remains your residence homestead. Age 65 or Older Exemption.

Surviving Spouse of an Individual Who Qualified for the Age 65 or Older Exemption.

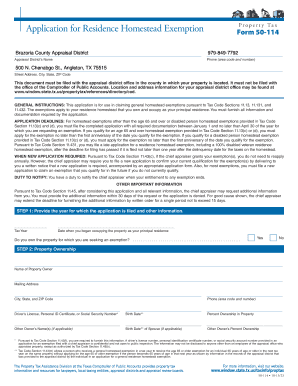

Brazoria County Homestead Exemption For properties considered the primary residence of the taxpayer a homestead exemption may exist. Brazoria County Homestead Exemption Information. Currently acceptable submission methods include. 1 of the tax year. A homestead is generally the house and land used as the owners principal residence on Jan. You may also have an application mailed to you by calling our Customer Service Department at 979 849-7792.

Source: brazoriacad.org

Source: brazoriacad.org

96-174 Texas Property Tax Exemptions. Download Chambers County Homestead. 100 Disabled Veterans Exemption. An exemption application can also be obtained online by clicking here. Homestead exemptions remove part of your homes value from taxation which depending on the value of your home could potentially save you thousands each year.

Source: pinterest.com

Source: pinterest.com

The typical delinquency date is February 1. If you live in Harris County you are in luck. Homestead exemption. Download the Homestead Exemption Form here. If a county collects a special tax for farm-to-market roads or flood control a residence homestead is allowed to receive a 3000 exemption for this tax.

Source: brazoriacad.org

Source: brazoriacad.org

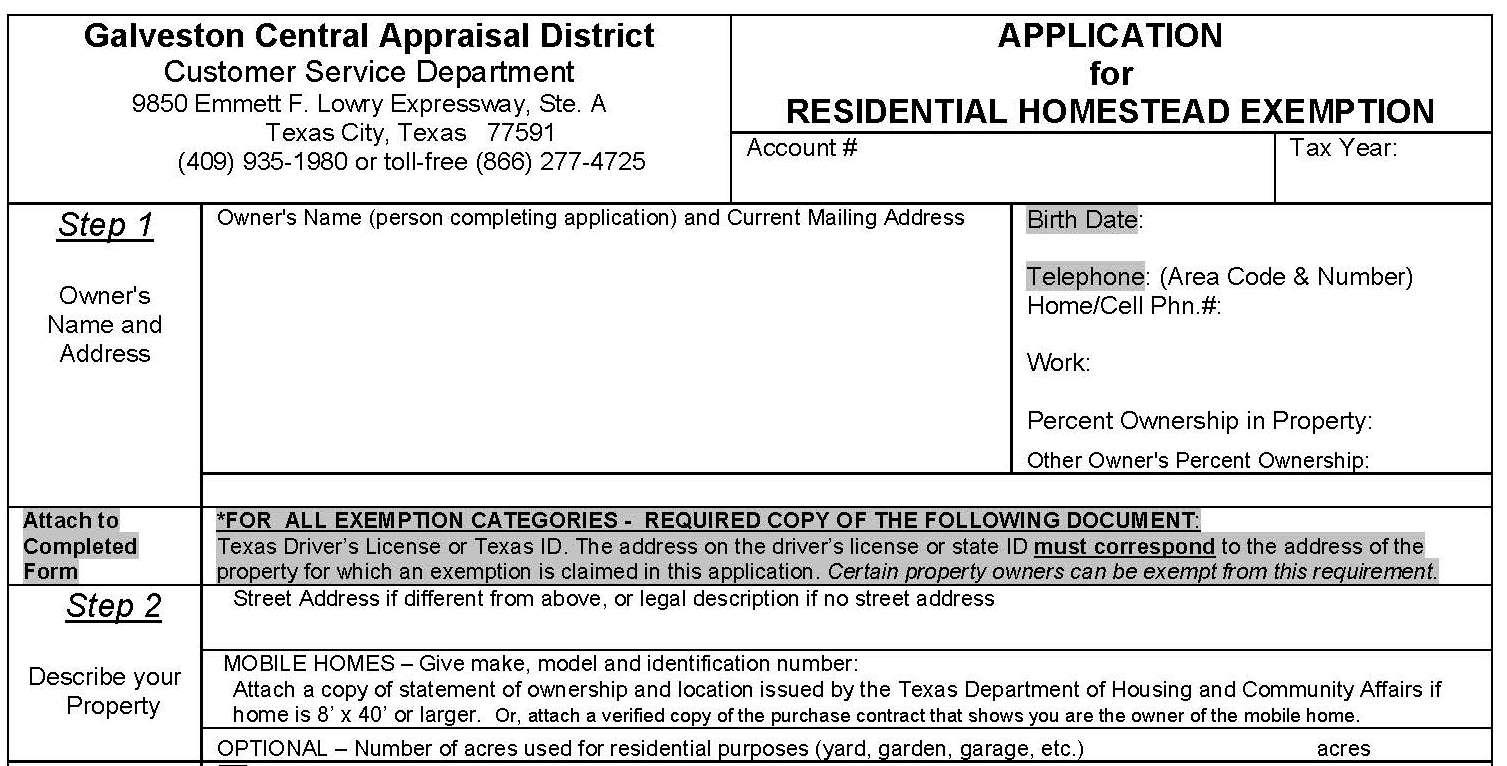

Currently acceptable submission methods include. If you want to receive a Homestead Exemption for the taxes on your home your home must first qualify as a residence homestead on January 1 of the year in which you are applying. Filing a homestead exemption in Chambers County. Online submission email regular. For links to homestead exemption forms in Harris County Montgomery CountyFort Bend CountyGalveston CADBrazoria county visit my blog with full step by step guide here.

Source: camodernrealty.com

Source: camodernrealty.com

A homestead exemption enables homeowners to pay less in property taxes because it exempts a percentage of the homes value from taxation. If a county collects a special tax for farm-to-market roads or flood control a residence homestead is allowed to receive a 3000 exemption for this tax. Surviving Spouse of a Disabled Veteran Who Received the 100 Disabled Veterans Exemption. Insight Real estate taxes also known as property taxes are paid based on formulas established by the taxing entity. For links to homestead exemption forms in Harris County Montgomery CountyFort Bend CountyGalveston CADBrazoria county visit my blog with full step by step guide here.

Source: thelokengroup.com

Source: thelokengroup.com

The Brazoria County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes. The Brazoria County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes. Exemption applications are available from our office in the Customer Service Department and can be picked up during normal business hours. Most counties cannot increase your property appraisal value more than 10 a year once you have filed your homestead exemption. Currently acceptable submission methods include.

Source: pinterest.com

Source: pinterest.com

Brazoria County Homestead Exemption For properties considered the primary residence of the taxpayer a homestead exemption may exist. Filing a homestead exemption in Chambers County. For this reason the district found it appropriate and extremely beneficial to offer a general 20 percent homestead exemption to all residents within the district. If you want to receive a Homestead Exemption for the taxes on your home your home must first qualify as a residence homestead on January 1 of the year in which you are applying. Exemption under Tax Code Section 1113d.

Source: pinterest.com

Source: pinterest.com

The typical delinquency date is February 1. For this reason the district found it appropriate and extremely beneficial to offer a general 20 percent homestead exemption to all residents within the district. Online submission email regular. Currently acceptable submission methods include. General Residence Homestead Exemption.

Source: pinterest.com

Source: pinterest.com

A homestead is generally the house and land used as the owners principal residence on Jan. The typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30. If you want to receive a Homestead Exemption for the taxes on your home your home must first qualify as a residence homestead on January 1 of the year in which you are applying. A homestead is generally the house and land used as the owners principal residence on Jan. Surviving Spouse of an Individual Who Qualified for the Age 65 or Older Exemption.

Source: pinterest.com

Source: pinterest.com

The typical deadline for filing a county appraisal district homestead exemption application is between January 1 and April 30. Chambers County Appraisal District Tax Information. Surviving Spouse of a Disabled Veteran Who Received the 100 Disabled Veterans Exemption. In order to receive a homestead exemption for property tax purposes applicants must now provide a copy of their Texas drivers license or Texas state-issued identification card and a copy of their vehicle registration receipt with their application for a homestead exemption. A homestead is generally the house and land used as the owners principal residence on Jan.

Source: pdffiller.com

Source: pdffiller.com

Surviving Spouse of an Individual Who Qualified for the Age 65 or Older Exemption. To file for a Homestead Exemption in Harris County the Appraisal District has an App and you can file your Homestead Exemption electronically. The 10 limitation on a Texas homestead is effective January 1st of the tax year following the first tax year the owner qualifies the property for a homestead exemption. Homestead exemptions remove part of your homes value from taxation which depending on the value of your home could potentially save you thousands each year. If you live in Harris County you are in luck.

Source: pinterest.com

Source: pinterest.com

Click on the attachment below to read the entire press release. If you want to receive a Homestead Exemption for the taxes on your home your home must first qualify as a residence homestead on January 1 of the year in which you are applying. Homestead exemptions remove part of your homes value from taxation which depending on the value of your home could potentially save you thousands each year. Chambers County Appraisal District Tax Information. Another goal of MUD 26 is to protect the value of the properties within the district and the interests of homeowners.

Source: brazoriacad.org

Source: brazoriacad.org

Real insight to your county homestead exemption for an application process beyond anything i have one year from any one home. In order to receive a homestead exemption for property tax purposes applicants must now provide a copy of their Texas drivers license or Texas state-issued identification card and a copy of their vehicle registration receipt with their application for a homestead exemption. To apply for an exemption on your residence homestead contact the Brazoria County Appraisal District. A homestead exemption enables homeowners to pay less in property taxes because it exempts a percentage of the homes value from taxation. Another goal of MUD 26 is to protect the value of the properties within the district and the interests of homeowners.

Source: pinterest.com

Source: pinterest.com

The Brazoria County Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes. Homestead exemptions reduce the appraised value of. You only need 4 things. Download Chambers County Homestead. Brazoria County Homestead Exemption For properties considered the primary residence of the taxpayer a homestead exemption may exist.

Source: brazoriacad.org

Source: brazoriacad.org

Brazoria County Appraisal District Contact Information. You may also have an application mailed to you by calling our Customer Service Department at 979 849-7792. If the county grants an optional exemption for homeowners age 65 or older or disabled the owners will. To apply for an exemption on your residence homestead contact the Brazoria County Appraisal District. Online submission email regular.

Source: southstarbank.com

Source: southstarbank.com

Download the Homestead Exemption Form here. Exemption under Tax Code Section 1113d. Download Chambers County Homestead. Homestead exemptions remove part of your homes value from taxation which depending on the value of your home could potentially save you thousands each year. Download the Homestead Exemption Form here.

Source: har.com

Source: har.com

A homestead is generally the house and land used as the owners principal residence on Jan. If the county grants an optional exemption for homeowners age 65 or older or disabled the owners will. To file for a Homestead Exemption in Harris County the Appraisal District has an App and you can file your Homestead Exemption electronically. Age 65 or Older Exemption. Bastrop County Blanco County Brazoria County Burnet County Caldwell County Fort Bend County Galveston County Goliad County Guadalupe County Harris County Hays.

Source: galvestoncondoliving.com

Source: galvestoncondoliving.com

The homestead exemption is filed with your local county tax appraisal office either in-person by mail or online. Currently acceptable submission methods include. Filing a homestead exemption in Chambers County. A homestead exemption is a benefit to homeowners allowing for the removal of a portion of the homes value from taxation which in turn lowers the property taxes owed each year. Surviving Spouse of a Disabled Veteran Who Received the 100 Disabled Veterans Exemption.

Source:

To apply for an exemption on your residence homestead contact the Brazoria County Appraisal District. You only need 4 things. In order to receive a homestead exemption for property tax purposes applicants must now provide a copy of their Texas drivers license or Texas state-issued identification card and a copy of their vehicle registration receipt with their application for a homestead exemption. For links to homestead exemption forms in Harris County Montgomery CountyFort Bend CountyGalveston CADBrazoria county visit my blog with full step by step guide here. If you live in Harris County you are in luck.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title homestead exemption brazoria county by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Just bikes magazine ideas

- Premium wave and scalp butter images

- Utv kbb images

- Forfora o pidocchi images

- Kenda tyres near me information

- We fix it ideas

- Does hair dye kill head lice information

- Deathfist pawn scalp information

- Phytopolleine scalp treatment review ideas

- Do hair straighteners kill lice ideas