Homestead exemption brevard county florida images

Home » Wallpapers » Homestead exemption brevard county florida images

Your Homestead exemption brevard county florida images are ready. Homestead exemption brevard county florida are a topic that is being searched for and liked by netizens now. You can Download the Homestead exemption brevard county florida files here. Download all free images.

If you’re searching for homestead exemption brevard county florida pictures information linked to the homestead exemption brevard county florida interest, you have come to the ideal site. Our site always gives you suggestions for downloading the highest quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

Homestead Exemption Brevard County Florida. A board of county commissioners or the governing authority of any municipality may adopt an ordinance to allow an additional homestead exemption equal to the assessed value of the property. These exemptions apply only to the tax millage a county or city levies when it adopts a local ordinance and do not apply to the millage of school districts or other taxing units. Good News for all that missed the deadline for filing for Homestead Exemption in the state of Florida. How to File for Homestead Exemption in Brevard County Florida Important Deadlines.

Santa Can T Do What Real Estate Advertising Home Buying Real Estate Infographic From pinterest.com

Santa Can T Do What Real Estate Advertising Home Buying Real Estate Infographic From pinterest.com

Under Florida law failure to file homestead exemption by March 1 20constitutes 22 a waiver of the exemption privilege for the year. You can apply for your Homestead Exemption weekdays from 800 am to 500 pm at any of the following Property Appraisers Oces. There is a standard 25000 exemption plus an additional exemption up to 25000. As of December 31st be living in the homestead property to qualify for homestead in the following year Be a permanent resident of the state in which the property was purchased and a US. If you qualify you can reduce the assessed value of your homestead up to 50000. To qualify for the homestead tax exemption contact the Brevard County Property Appraisers office at wwwBCPAOus Proof of Fire and extended home insurance coverage in an amount at least equal to the total of all outstanding liens including a lien for deferred taxes non-ad valorem assessments and interest with a loss payable clause to the Tax.

Good News for all that missed the deadline for filing for Homestead Exemption in the state of Florida.

Good News for all that missed the deadline for filing for Homestead Exemption in the state of Florida. Homestead exemptions described below. These exemptions apply only to the tax millage a county or city levies when it adopts a local ordinance and do not apply to the millage of school districts or other taxing units. Contact your local property appraiser for information on any ordinances passed in your county. You can apply for your Homestead Exemption weekdays from 800 am to 500 pm at any of the following Property Appraisers Oces. If you purchased a new home or condo in the State of Florida and made it your permanent residence prior to January 1 2020 you may file for tax year 2020 Homestead and other exemptions until September 18 2020.

Source: kin.com

Source: kin.com

The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities. There is a standard 25000 exemption plus an additional exemption up to 25000. Contact your local property appraiser for information on any ordinances passed in your county. The homestead exemption in Florida can save you hundreds of dollars in property taxes if you are a permanent Florida resident. Every person who owns real property in Florida on January 1 makes the property his or her permanent residence or the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to 50000.

Source: pinterest.com

Source: pinterest.com

YOU MUST OWN AND ESTABLISH YOUR PERMANENT RESIDENCE ON THE PROPERTY ON OR BEFORE JANUARY 1ST. Do You Qualify for a Homestead Exemption in Brevard County. To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the office at 321 264-6930 or visit the Contact Us page to send an electronic message. Homestead Exemptions The Brevard County Tax Assessor can provide you with an application form for the Brevard County homestead exemption which can provide a modest property tax break for properties which are used as the primary residence of their owners. If property is held in a Trust list names of applicant s below by clicking on Add New Owner and then clicking Update to save.

Source: bcpao.us

Source: bcpao.us

If you purchased a new home after January 1 202and you are a resident of Brevard County you may qualify for a savings on your 2023tax bill by pre-filing for homestead exemption after March 1 2022. Owns real estate with a just value less than 250000. Every person who owns real property in Florida on January 1 makes the property his or her permanent residence or the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to 50000. Must be entitled to claim homestead tax exemption. The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities.

Source: in.pinterest.com

Source: in.pinterest.com

If you qualify you can reduce the assessed value of your homestead up to 50000. Brevard County Property Appraiser - Home Page. If you own a home in Florida and live in it as your primary residence then Florida law typically allows you a 25000 tax exemption on the assessed value of the property. Additional exemptions might be available for farmland green space veterans or others. Contact your local property appraiser for information on any ordinances passed in your county.

For example in Florida exemption applicants have to. AN APPLICATION MUST BE FILED WITH THE PROPERTY APPRAISERS OFFICE ON OR BEFORE MARCH 1ST. According to the Florida Constitution anybody who has a title to their property in the State of Florida designated as their permanent home is eligible to receive a homestead exemption. Under Florida law failure to file homestead exemption by March 1 20constitutes 22 a waiver of the exemption privilege for the year. As of December 31st be living in the homestead property to qualify for homestead in the following year Be a permanent resident of the state in which the property was purchased and a US.

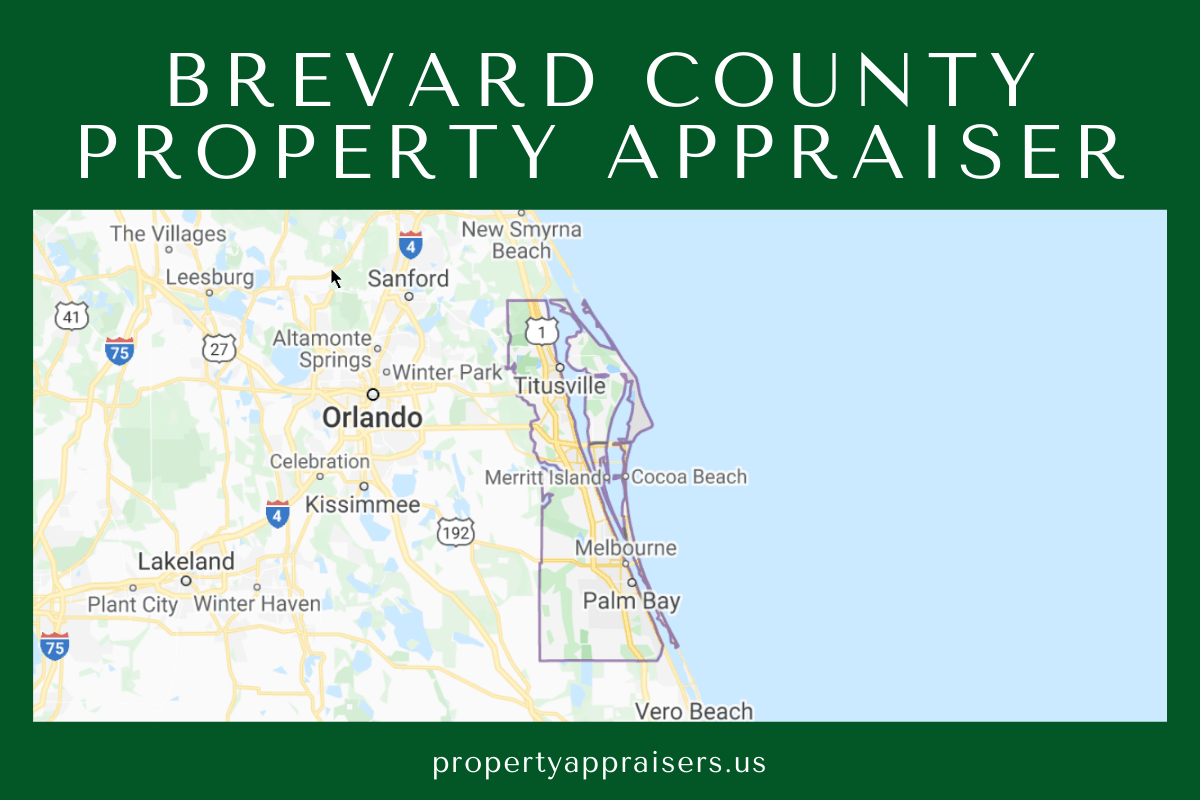

Source: propertyappraisers.us

Source: propertyappraisers.us

Every person who owns real property in Florida on January 1 makes the property his or her permanent residence or the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to 50000. If you are looking for how to file for homestead exemption in Brevard County keep reading. Owns real estate with a just value less than 250000. Every person who owns real property in Florida on January 1 makes the property his or her permanent residence or the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to 50000. Brevard County Property Appraiser - Property Tax Exemptions.

Source: brevardtaxcollector.com

Source: brevardtaxcollector.com

If you purchased a new home after January 1 202and you are a resident of Brevard County you may qualify for a savings on your 2023tax bill by pre-filing for homestead exemption after March 1 2022. Contact your local property appraiser for information on any ordinances passed in your county. You can apply for your Homestead Exemption weekdays from 800 am to 500 pm at any of the following Property Appraisers Oces. Good News for all that missed the deadline for filing for Homestead Exemption in the state of Florida. Under Florida law failure to file homestead exemption by March 1 20constitutes 22 a waiver of the exemption privilege for the year.

How to File for Homestead Exemption in Brevard County Florida Important Deadlines. Homestead exemptions described below. Brevard County Property Appraiser - Property Tax Exemptions. You can apply for your Homestead Exemption weekdays from 800 am to 500 pm at any of the following Property Appraisers Oces. Good News for all that missed the deadline for filing for Homestead Exemption in the state of Florida.

Source: pinterest.com

Source: pinterest.com

If you purchased a new home or condo in the State of Florida and made it your permanent residence prior to January 1 2020 you may file for tax year 2020 Homestead and other exemptions until September 18 2020. This is an exemption that can be valued up to 50000. Must be entitled to claim homestead tax exemption. Citizen Typically be the primary property owner. If you are looking for how to file for homestead exemption in Brevard County keep reading.

Source: clickorlando.com

Source: clickorlando.com

Under Florida law failure to file homestead exemption by March 1 20constitutes 22 a waiver of the exemption privilege for the year. The first 25000 applies to all property taxes. For any additional Owners click on Add New Owner again enter the owner and click on Update to save. As of December 31st be living in the homestead property to qualify for homestead in the following year Be a permanent resident of the state in which the property was purchased and a US. If you are looking for how to file for homestead exemption in Brevard County keep reading.

Source: pinterest.com

Source: pinterest.com

A board of county commissioners or the governing authority of any municipality may adopt an ordinance to allow an additional homestead exemption equal to the assessed value of the property. Contact your local property appraiser for information on any ordinances passed in your county. Citizen Typically be the primary property owner. Homestead Exemptions The Brevard County Tax Assessor can provide you with an application form for the Brevard County homestead exemption which can provide a modest property tax break for properties which are used as the primary residence of their owners. A board of county commissioners or the governing authority of any municipality may adopt an ordinance to allow an additional homestead exemption equal to the assessed value of the property.

Source: pinterest.com

Source: pinterest.com

Under Florida law failure to file homestead exemption by March 1 20constitutes 22 a waiver of the exemption privilege for the year. Every person who owns real property in Florida on January 1 makes the property his or her permanent residence or the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to 50000. According to the Florida Constitution anybody who has a title to their property in the State of Florida designated as their permanent home is eligible to receive a homestead exemption. An exemption not exceeding 50000 to any person who has the legal or equitable title to real. The added 25000 applies to assessed value over.

Source:

Source:

Citizen Typically be the primary property owner. The Brevard County Tax Collectors Office is committed to ensuring website accessibility for people with disabilities. The first 25000 applies to all property taxes. For example in Florida exemption applicants have to. Brevard County Government Complex - North 400 South Street 5th Floor Titusville Florida 32780 321 264-6700 Brevard County Government Center 2725 Judge Fran Jamieson Way Building C 1st Floor Viera Florida 32940.

An exemption not exceeding 50000 to any person who has the legal or equitable title to real. The first 25000 applies to all property taxes. If you purchased a new home after January 1 202and you are a resident of Brevard County you may qualify for a savings on your 2023tax bill by pre-filing for homestead exemption after March 1 2022. If you qualify you can reduce the assessed value of your homestead up to 50000. Do You Qualify for a Homestead Exemption in Brevard County.

Source: pinterest.com

Source: pinterest.com

Owns real estate with a just value less than 250000. According to the Florida Constitution anybody who has a title to their property in the State of Florida designated as their permanent home is eligible to receive a homestead exemption. If you qualify you can reduce the assessed value of your homestead up to 50000. Do You Qualify for a Homestead Exemption in Brevard County. Homestead exemptions described below.

Source: fool.com

Source: fool.com

How to File for Homestead Exemption in Brevard County Florida Important Deadlines. If property is held in a Trust list names of applicant s below by clicking on Add New Owner and then clicking Update to save. Homestead exemptions described below. Every person who owns real property in Florida on January 1 makes the property his or her permanent residence or the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to 50000. To report an ADA accessibility issue request accessibility assistance regarding our website content or to request a specific electronic format please contact the office at 321 264-6930 or visit the Contact Us page to send an electronic message.

AN APPLICATION MUST BE FILED WITH THE PROPERTY APPRAISERS OFFICE ON OR BEFORE MARCH 1ST. The first 25000 applies to all property taxes. For example in Florida exemption applicants have to. Every person who owns real property in Florida on January 1 makes the property his or her permanent residence or the permanent residence of a legal or natural dependent and files an application may receive a property tax exemption up to 50000. If you own a home in Florida and live in it as your primary residence then Florida law typically allows you a 25000 tax exemption on the assessed value of the property.

Source: fi.pinterest.com

Source: fi.pinterest.com

A person may be eligible for this exemption if he or she meets the following requirements. If you own a home in Florida and live in it as your primary residence then Florida law typically allows you a 25000 tax exemption on the assessed value of the property. Contact your local property appraiser for information on any ordinances passed in your county. There is a standard 25000 exemption plus an additional exemption up to 25000. Good News for all that missed the deadline for filing for Homestead Exemption in the state of Florida.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title homestead exemption brevard county florida by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.

Category

Related By Category

- Just bikes magazine ideas

- Premium wave and scalp butter images

- Utv kbb images

- Forfora o pidocchi images

- Kenda tyres near me information

- We fix it ideas

- Does hair dye kill head lice information

- Deathfist pawn scalp information

- Phytopolleine scalp treatment review ideas

- Do hair straighteners kill lice ideas